"As our shareholders know, we have made a decision to continuously and significantly lower prices for customers year after year as our efficiency and scale make it possible. This is an example of a very important decision that cannot be made in a math-based way. In fact, when we lower prices, we go against the math that we can do, which always says that the smart move is to raise prices. We have significant data related to price elasticity. With fair accuracy, we can predict that a price reduction of a certain percentage will result in an increase in units sold of a certain percentage. With rare exceptions, the volume increase in the short term is never enough to pay for the price decrease. However, our quantitative understanding of elasticity is short-term. We can estimate what a price reduction will do this week and this quarter. But we cannot numerically estimate the effect that consistently lowering prices will have on our business over five years or ten years or more. Our judgment is that relentlessly returning efficiency improvements and scale economies to customers in the form of lower prices create a virtuous cycle that leads over the long term to a much larger dollar amount of free cash flow, and thereby to a much more valuable Amazon.com."

In the 10 years following the statement above Amazon's book value increased more than 4000% to $10,7 billion today.

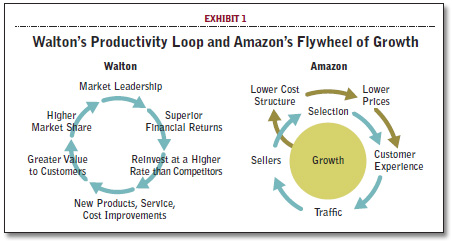

Sam Walton of Walmart and Amazon’s Jeff Bezos both got this. They understood the value of leveraging supply chain capability to delight a critical market segment, or to support an initiative that differentiates them from the competition, or to focus on the “big” economics (top line or total profit, for example) rather than traditional supply chain cost minimization (lower cost of goods sold % ie increasing gross margin %s). Bezos is often credited with developing the “Amazon Flywheel of Growth” on a napkin.

Comments, questions or E-mails welcome: ajbrenninkmeijer@gmail.com

No comments:

Post a Comment