Vandaag in de FD en op Twitter schreef Marco Groot: "#Aalberts. geweldig bedrijf, om van te houden maar niet om te houden op deze waardering."

Superinvesteerder drs. Hendrik Oude Nijhuis schreef: "Eindelijk hebben we dan een goed bedrijf gevonden, met goede vooruitzichten én een goed management. Eén ding mist dan nog: een goede prijs...

Superinvesteerder drs. Hendrik Oude Nijhuis schreef: "Eindelijk hebben we dan een goed bedrijf gevonden, met goede vooruitzichten én een goed management. Eén ding mist dan nog: een goede prijs...

Superinvesteerder drs. Hendrik Oude Nijhuis schreef: "Eindelijk hebben we dan een goed bedrijf gevonden, met goede vooruitzichten én een goed management. Eén ding mist dan nog: een goede prijs...

Superinvesteerder drs. Hendrik Oude Nijhuis schreef: "Eindelijk hebben we dan een goed bedrijf gevonden, met goede vooruitzichten én een goed management. Eén ding mist dan nog: een goede prijs...

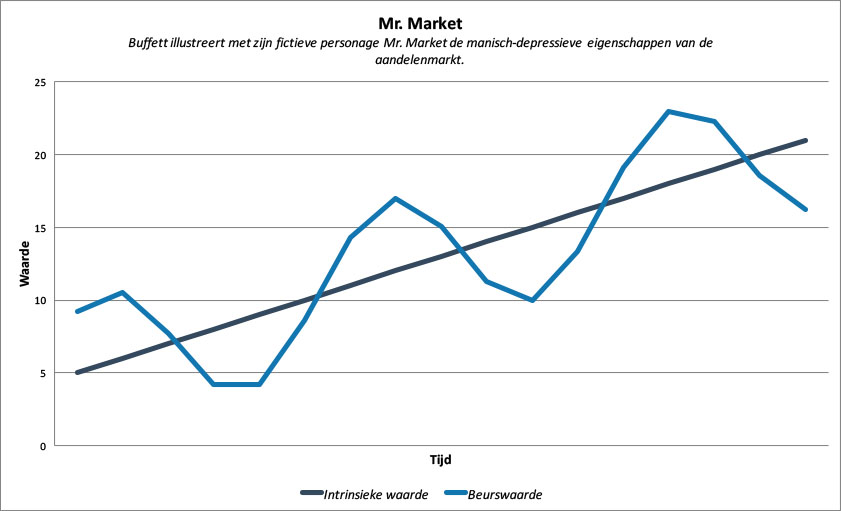

Met een goede prijs bedoel ik dat de aandelen kunnen worden ingeslagen tegen een fractie van de échte waarde. Hierbij geldt dat de echte (intrinsieke) waarde van een onderneming vaak vrij constant is; de beurskoers fluctueert er omheen... (zie onderstaand figuur).

De ene keer noteert de beurskoers aanmerkelijk ónder die echte waarde: dan is sprake van onderwaardering en kunt u aandelen kopen. Op een later moment noteert de koers – van datzelfde bedrijf – juist bóven de echte waarde. Dan is sprake van overwaardering. En u raadt het al... dit is het moment om de winst te incasseren!"

Warren Buffett illustreert de eigenschappen van de aandelenmarkt met het manisch-depressieve personage Mr. Market. Dit fictieve personage is oorspronkelijk bedacht door Benjamin Graham (1894 – 1976), de grondlegger van de ‘value investing’-filosofie én leermeester van Warren Buffett.

Bron: www.valueselections.net

De beste tijden om Aalberts te Kopen waren 2001, 2002, 2003, 2009, 2010, 2012.

The graph above (that I made) showed actual value calculations made by Syb van Slingerlandt during the past decade. Stock prices including the July 2012, were compared to the Van Slingerlandt's valuation of Aalberts Industries.(AALB NL).

Green line = Value.

Red line = Margin of Safety.

Blue = Stock Price.

Koop = Buy

Verkoop= Sell

Conclusion (was):

Now might be a good time to start buying Aalberts because the Price (€11,75) you pay, is lower than the (calculated) Value (€18,70) that you get.

-----------------------------------------------------------------------------------------------

Vandaag december 2015 is de koers gestegen tot boven 30 euro en een eenvoudige Graham Number schatting van de bedrijfseconomische waarde is ongeveer 20 euro. Nu verkopen en terug kopen als de koers richting 20 euro gaat, lijkt een veiligere optie.

Graham Defensive analysis based on The Intelligent Investor book Chapter 14:

SECTOR: [PASS] Aalberts is neither a technology nor financial Company, and therefore this methodology is applicable.

SALES: [PASS] The investor must select companies of "adequate size". This includes companies with annual sales greater than €260 million. Aalberts' sales of €2,201 million, based on 2014 sales, pass this test.

CURRENT RATIO: [FAIL] The current ratio must be greater than or equal to 2. Companies that meet this criterion are typically financially secure and defensive. Aalberts' current ratio €801m/€644m of 1.2 fails the test.

LONG-TERM DEBT IN RELATION TO NET CURRENT ASSETS: [FAIL] For industrial companies, long-term debt must not exceed net current assets (current assets minus current liabilities). Companies that meet this criterion display one of the attributes of a financially secure organization. The long-term debt for Aalberts is €619 million, while the net current assets are €157 million. Aalberts fails this test.

LONG-TERM EPS GROWTH: [PASS] Companies must increase their EPS by at least 30% over a ten-year period and EPS must not have been negative for any year within the last 5 years. Companies with this type of growth tend to be financially secure and have proven themselves over time. Aalberts' EPS growth over that period of 89% passes the EPS growth test.

SECTOR: [PASS] Aalberts is neither a technology nor financial Company, and therefore this methodology is applicable.

SALES: [PASS] The investor must select companies of "adequate size". This includes companies with annual sales greater than €260 million. Aalberts' sales of €2,201 million, based on 2014 sales, pass this test.

CURRENT RATIO: [FAIL] The current ratio must be greater than or equal to 2. Companies that meet this criterion are typically financially secure and defensive. Aalberts' current ratio €801m/€644m of 1.2 fails the test.

LONG-TERM DEBT IN RELATION TO NET CURRENT ASSETS: [FAIL] For industrial companies, long-term debt must not exceed net current assets (current assets minus current liabilities). Companies that meet this criterion display one of the attributes of a financially secure organization. The long-term debt for Aalberts is €619 million, while the net current assets are €157 million. Aalberts fails this test.

LONG-TERM EPS GROWTH: [PASS] Companies must increase their EPS by at least 30% over a ten-year period and EPS must not have been negative for any year within the last 5 years. Companies with this type of growth tend to be financially secure and have proven themselves over time. Aalberts' EPS growth over that period of 89% passes the EPS growth test.

EARNINGS YIELD: [FAIL] The Earnings/Price (inverse

P/E) %, based on the lesser of the current Earnings Yield or the Yield using

average earnings over the last 3 fiscal years, must be "acceptable",

which this methodology states is greater than 6,5%. Stocks with higher earnings

yields are more defensive by nature. Aalberts's E/P

of 4% (using the average of last 3 years) fails this test.

GRAHAM NUMBER VALUE: [FAIL] The Price/Book ratio must also be reasonable. That is the Graham number value must be greater than the market price. Aalberts has a Graham number of √(22,5 x €1,4 EPS x €11 Book Value) = €18,7

Comments, questions or E-mails welcome: ajbrenninkmeijer@gmail.com

No comments:

Post a Comment