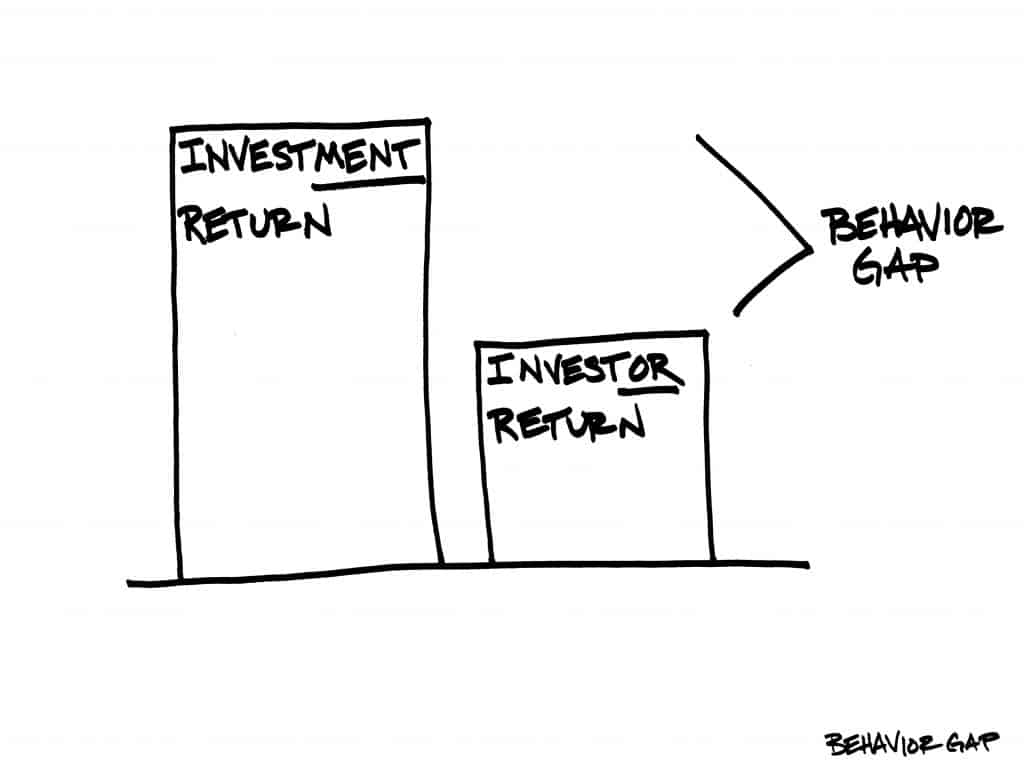

Our goal is to have a higher InvestOR than InvestMENT return. That is a higher Money- than Time-weighted return. Investors often chase the performance of an asset or fund. After the price has gone up significantly they buy and after the price has gone down they sell.

This leads to a Behaviour Gap whereby InvestORs on average earn less than the net proceeds of the Investment of the fund they have invested in.

Consider a fund where the Net Asset Value decreases by 50% in the first year and increases 140% in the second year. Over two years the Net Asset Value has increased by 20% (from EUR 100 to EUR 120). This 20% return is called the Time-weighted return. It is the return of the InvestMENT over 2 years.

Now what would the average InvestOR dollar earn if there was panic after the first year? Say the fund started with EUR 1 000 000 and after falling in Net Asset Value by 50% the Assets Under Management is EUR 500 000. Imagine if the participants in the fund panic and 90% is sold off and returned to investors.

EUR 50 000 remains, which increases in price by 140% to EUR . InvestORs have lost EUR 500 000 and earned EUR 70 000,-. On average investORs have lost money and not gained 20%.

Consider the opposite happening: The fund starts with EUR 100 000 Assets Under Management and loses 50% of NAV and thus EUR 50 000,-. The Margin of Safety might have increased and now InvestORs buy more Units (Participaties) of the fund, say EUR 900 000. Now the Net Asset Value increases by 140%. InvestORs have lost EUR 50 000 and earned EUR 1 330 000,- clearly the average InvestOR return is much higher than the InvestMENT return of 20%.

Now there is EUR 950 000 invested at the beginning of Year 2. The Net Asset Value increases by 140%. InvestORs have lost EUR 50 000 and earned EUR 1 330 000,- clearly the average InvestOR return is much higher than the InvestMENT return of 20%.

No comments:

Post a Comment