My colleagues, Hendrik Oude Nijhuis en Björn Kijl, suggested buying Hunter Douglas (long before I had even heard of value investing) in 2010 as part of their https://www.valueselections.net/ service. The share price was EUR 28,50 and their calculation of intrinsic value was EUR 45 at the time. If you had bought and held your return excluding dividends would have been 16% per year even though the share price was flat or declining for a number of years in the interim.

Error of omission I never bought the stock and didn't suggest it for ValueMachinesFund, even though I wrote: Conclusion: February 2020 still a buy.

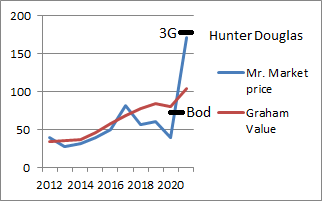

A little over a year ago the founding family made an offer (bod) of EUR 64, but some minority shareholders did not sell. Now 3G is offering EUR 175 which seems pretty good to me.

Benjamin Graham Defensive Analysis Janury 2022:

SECTOR: [PASS] Hunter Douglas is in manufacturing (of window coverings). Technology and financial stocks were considered too risky to invest in when this methodology was published.

SALES: [PASS] The investor must select companies of "adequate size". This includes companies with annual sales greater than €260 million. Hunter Douglas' sales of €3 900 million, based on 2021 sales, passes this test.

CURRENT RATIO: [FAIL] The current ratio must be greater than or equal to 2. Companies that meet this criterion are typically financially secure and defensive. Hunter Douglas' current ratio €1 497m/€983m of 1,5 isn't bad but fails this test.

LONG-TERM DEBT IN RELATION TO NET CURRENT ASSETS: [PASS] For industrial companies, long-term debt must not exceed net current assets (current assets minus current liabilities). Companies that do not meet this criterion lack the financial stability that this methodology likes to see. The long-term debt for Hunter Douglas is €455 million, while the net current assets are €486 million. Hunter Douglas passes this test.

LONG-TERM EPS GROWTH: [PASS] Companies must increase their EPS by at least 30% over a ten-year period and EPS must not have been negative for any year within the last 5 years. Companies with this type of growth tend to be financially secure and have proven themselves over time. Hunter Douglas' earnings have increased during the past 10 years by more than 50%.

Earnings Yield: [FAIL] The Earnings/Price (inverse P/E) %, based on the lesser of the current Earnings Yield or the Yield using average earnings over the last 3 fiscal years, must be "acceptable", which this methodology states is greater than 6,5%. Stocks with higher earnings yields are more defensive by nature. Hunter Douglas' E/P of 5% (using the average of 3 years Earnings) fails this test.

Graham Number value: [FAIL] The Price/Book ratio must also be reasonable. That is the Graham number value must be greater than the market price. Hunter Douglas has a Graham number of √(15 x € 9 EPS x 1,5 x €55 Book Value) = €104

No comments:

Post a Comment